Some Of Offshore Banking

Table of ContentsWhat Does Offshore Banking Mean?Indicators on Offshore Banking You Need To KnowThe Ultimate Guide To Offshore BankingOffshore Banking Things To Know Before You Get ThisHow Offshore Banking can Save You Time, Stress, and Money.Excitement About Offshore BankingThe Ultimate Guide To Offshore BankingFacts About Offshore Banking UncoveredThe Ultimate Guide To Offshore Banking

This process assists produce liquidity in the marketwhich develops money and keeps the supply going. Similar to any type of other service, the goal of a bank is to make a earnings for its proprietors. For many banks, the owners are their investors. Financial institutions do this by billing more passion on the loans and other debt they provide to debtors than what they pay to individuals who utilize their financial savings cars.

Everything about Offshore Banking

Banks earn a profit by charging more interest to customers than they pay on financial savings accounts. A financial institution's dimension is figured out by where it lies as well as that it servesfrom small, community-based institutions to big industrial banks. According to the FDIC, there were just over 4,200 FDIC-insured commercial financial institutions in the United States as of 2021.

Conventional financial institutions provide both a brick-and-mortar place as well as an on the internet visibility, a new trend in online-only financial institutions arised in the early 2010s. These financial institutions commonly supply consumers higher passion prices and also lower charges. Benefit, rate of interest, and also costs are some of the variables that aid customers decide their favored banks.

Offshore Banking Fundamentals Explained

You must take into consideration whether you want to keep both business as well as individual accounts at the same bank, or whether you desire them at different banks. A retail financial institution, which has fundamental financial solutions for consumers, is the most suitable for daily financial. You can select a traditional bank, which has a physical building, or an online financial institution if you do not desire or require to physically visit get redirected here a bank branch.

, for example, takes down payments as well as lends in your area, which might offer a much more customized financial partnership. Choose a practical location if you are choosing a financial institution with a brick-and-mortar place.

The Best Strategy To Use For Offshore Banking

Some banks additionally supply smartphone applications, which can be beneficial. Examine the fees connected with the accounts you wish to open up. Banks bill interest on financings along with regular monthly maintenance charges, overdraft costs, and wire transfer costs. Some large financial institutions are transferring to finish overdraft account charges in 2022, so that can be an important factor to consider.

After making some marginal deductions (in the type of compensation), the financial institution pays the bill's worth to the holder. When the costs of exchange grows, the bank gets its settlement from the event, which had approved the costs.

Not known Incorrect Statements About Offshore Banking

Banks assist their customers in transferring funds from one place to an additional through cheques, drafts, and so on. A bank card is a card that permits its holders to make purchases of items and solutions in exchange for the charge card's carrier instantly paying for the items or solution. The cardholder debenture back the purchase amount to the card supplier over a long time and also with rate of interest.

Mobile financial (likewise understood as M-Banking) is a term used for carrying out equilibrium checks, account purchases, repayments, credit score applications, and various other financial transactions with a mobile phone such as a cellphone or Personal Digital Assistant (PERSONAL ORGANIZER), Approving deposits from savers or account holders is the key function of a financial institution.

Offshore Banking Things To Know Before You Get This

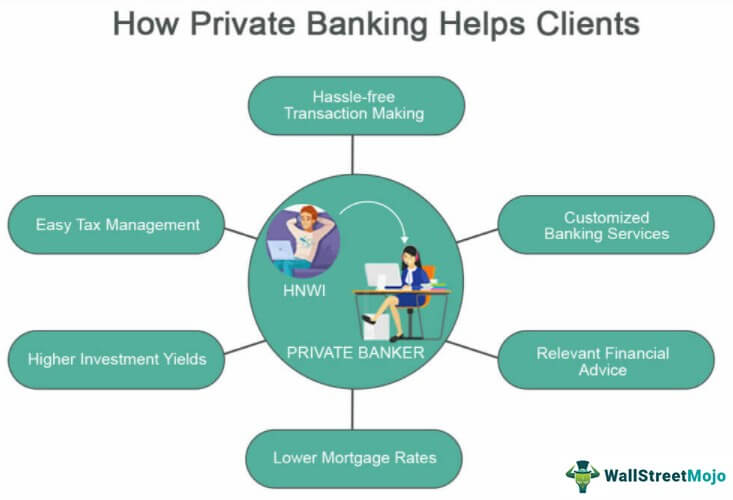

Individuals favor to transfer their cost savings in a financial institution since by doing so, they make passion. Priority financial can consist of several various solutions, yet some popular ones consist of cost-free checking, online bill pay, economic assessment, and also details. Customized financial as well as banking services are traditionally used to a financial institution's digital, high-net-worth people (HNWIs).

Private Financial institutions intend to match such individuals with one of the most appropriate alternatives. offshore banking.

9 Easy Facts About Offshore Banking Shown

Not look at this now only are cash market accounts Federal Down payment Insurance policy Corporation-insured, yet they gain greater rate of interest rates than click this site checking accounts. Cash market accounts minimize the risk of spending since you constantly have access to your money you can withdraw it at any type of time scot-free, though there might some restrictions on the variety of purchases you can make every month - offshore banking.

Corporate financial normally provides higher profits for banks as a result of the large quantities of cash and also rate of interest entailed with company fundings. In some cases both divisions overlap in terms of their solutions, however the genuine difference remains in the customers and the profits each financial kind gains. A business lender jobs carefully with customers to figure out which financial product or services best fit their requirements, such as company checking accounts, credit score cards, treasury monitoring, finances, also payment handling.

8 Simple Techniques For Offshore Banking

You desire to select a financial institution that offers a full variety of services so it supports your banking requires as your service expands. Below are some of the features to seek. ACH allows cash to be moved electronically without utilizing paper checks, cable transfers or cash money. It can be utilized for both payables and receivables.